How to register a company in Ghana (2023)

Summary

There are very few tasks as daunting as starting a new company. From generating initial capital to finally getting your products into the hands of consumers, the entrepreneurship journey can be a real challenging and sometimes frustrating one.

One key aspect of this journey is getting your company registered. This allows your company to be legally recognized by the state, which comes with its own set of benefits and obligations. Nonetheless, this is a very essential part of the startup process.

In this article you’ll learn the step by step process of registering a company in Ghana.

Read How to create, manage and monetize your YouTube channel in Ghana

Basic requirements

A company must meet the following minimum requirements before it can be registered in Ghana.

-

The company must have a name that is deemed appropriate and also not misleading. The proposed company name must be submitted to the Registrar General’s Department to ascertain its availability. The name must not conflict with the name of any other registered company. Once the availability of the name is confirmed and also deemed to be appropriate, it can either be reserved for future use or registered immediately.

-

The company is legally required to have a minimum of two competent directors.

-

The company is required to have at least one shareholder and a maximum of fifty if it is a private company.

-

The company is required to have an auditor and a secretary.

-

The company must have a documented set of rules governing its operation.

-

The company’s objectives must be stated and deemed to be in accordance with the laws of Ghana.

-

All directors and shareholders must provide their Tax Identification Number before the registration process can be completed.

Read How to pay Electricity Bill/Prepaid, Water Bill and NHIS Renewal Online or via Mobile Money Services

Registration procedure

-

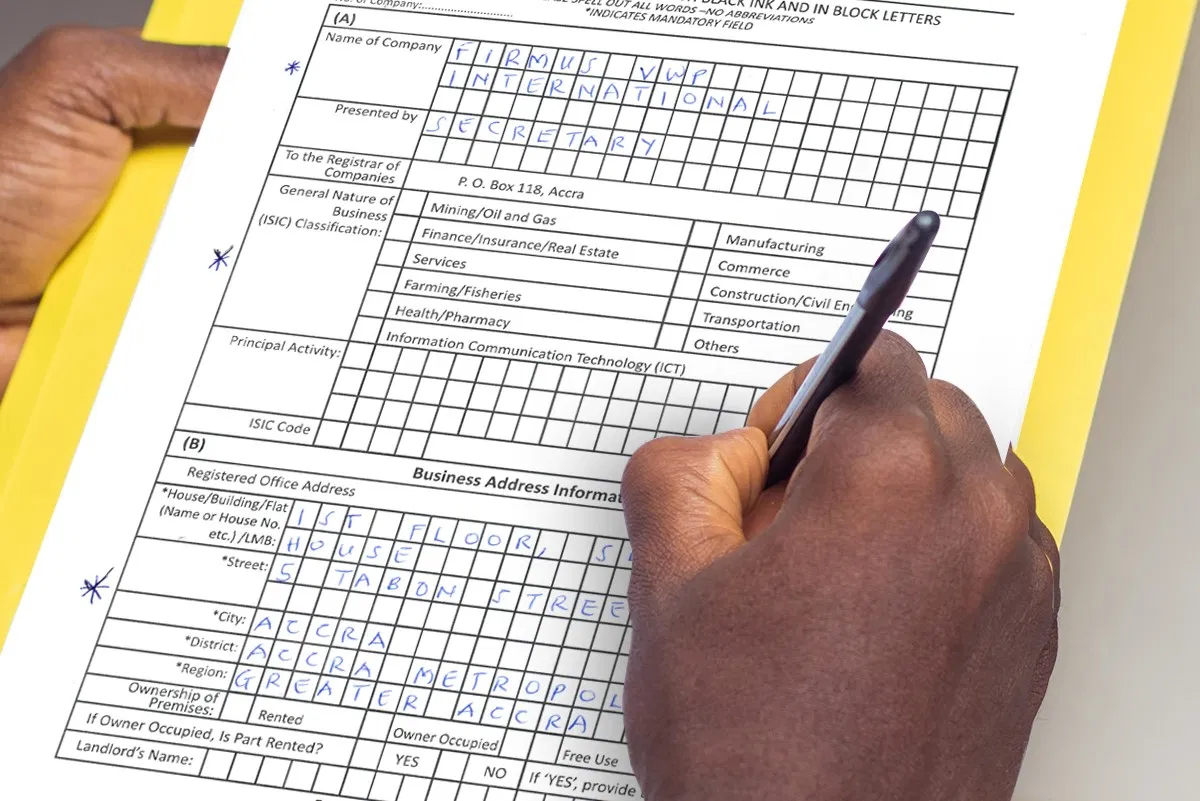

The first step is to purchase registration forms at the Registrar General’s Department or download them at www.rgd.gov.gh

-

The registration form consisting of “FORM 3”, “FORM 4”, “Tax Registration Form” and “Regulations” must be completed and submitted to the registration department.

-

You will be required to pay a registration fee as well as an amount equal to 0.5% of the company’s stated capital.

-

Once all necessary checks have been completed and all documents validated, you will be provided with certified copies of “FORM 3”, “FORM 4” and “Regulations”. You will also receive a “Certificate of Incorporation” and a “Certificate to Commence Business”. A Tax Identification Number(TIN) will also be provided for the company. The entire registration process may take about 7 to 21 days to be completed.

After the company has been incorporated, it is required by law to register with the following agencies.

Read How to borrow credit (airtime) and data bundles on all networks in Ghana

Ghana Revenue Authority

Registering with the Ghana Revenue Authority is a legal requirement for every company in Ghana. Once this is done, a certificate authorising the company to collect Value Added Tax (VAT) and National Health Insurance Levy (NHIL) will be issued. The company also receives a unique number for the payment of domestic taxes including income tax.

Social Security and National Insurance Trust (SSNIT)

The law requires all employers to register their employees under SSNIT, and ensure that all necessary contributions are made on their behalf.

Local Government Authority

All companies in Ghana are required to obtain a business operating permit from the Local Government Authority in their area of operation.

Read How to find your own phone number on all networks in Ghana

Comments